Grow Your Business by Helping Clients with Social Security.

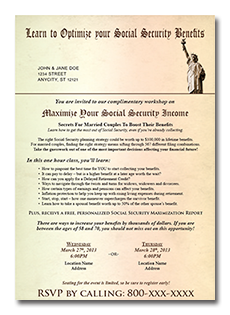

Anyone approaching retirement has questions about Social Security. But are you prepared to answer these questions? With our Social Security program, we not only prepare you to be an expert in Social Security issues, we put you in front of qualified prospects, putting you in the optimal position to close your business.

Social Security Planning is THE hottest topic in the Financial Planning field right now. If you aren't taking advantage of it, that means you're giving away this potential business to your competitors.

We are often asked “What Social Security has to do with Selling an Annuity?” Think back, have you ever been in an appointment and been asked: “When should I apply for my Social Security Benefits?” It’s a common question, did you know the answer?

For a single person, there are 8 different options to collect Social Security. For married couples, there are 567 different options. Deciding when and how to withdraw benefits is a critical step, but it does not stop there. There are several little-known strategies to help your clients leverage their benefits – from ways to maximize spousal benefits, to ways of reducing or eliminating taxation of Social Security benefits. Most people are being taxed 50% all the way up to 85% on their social security.

to ways of reducing or eliminating taxation of Social Security benefits. Most people are being taxed 50% all the way up to 85% on their social security.

This system is intended to help insurance agents take a social security lead and walk them through the appointment-setting process; all the way from the appointment to the sale.

Agents are not only educating, but helping these potential clients make retirement planning decisions. Using social security strategizing in your daily financial services will help tremendously. If you are a retirement specialist, you are already working with seniors, and the base of income for seniors is always social security. Shouldn’t you understand their most basic source of income? Shouldn’t you know how to position it properly, so while repositioning other investments, you could potentially save your clients thousands of dollars in taxes?